Pro-AV Business Index

Pro AV Growth Lifts as Uncertainty Poses Challenge

Highlights

- February saw a welcome rebound in the Pro AV Sales Index (AVI-S), with a 2.9-point increase from 51.1 to 54.0. While this is clearly a positive development, the negative aspect is that 54.0 is slow growth by pro AV’s high standards. For example, the index only had one month lower than 54.0 in the 42 months of pre-pandemic data. Still, a solid acceleration is more than welcome. This is made more positive given the headwinds coming in the form of tariffs and the related uncertainty. Commenters told us in no uncertain terms that these measures, and the lack of clarity about the business landscape in the coming months, are a major challenge and barrier to growth. Providers don’t know what prices to promise, and end users don’t know how to budget for upcoming project costs. Unfortunately, the uncertainty seems unlikely to abate, as the cycle of announcing and then postponing tariffs on Mexico and Canada is set to continue into April.

The primary impact of tariffs is on prices: The channel pays a significant tax as the equipment crosses the relevant border, then must recoup at least some of that cost from the end user. Unfortunately, there are also secondary growth effects from tariffs. In the U.S., the growth impact of the tariffs can be seen in equity markets, where the S&P 500 is now down from election day—a very unusual result for a republican president. This impact can be seen more acutely in the first two days of the first week of March, when it became clear that the Trump administration would indeed be imposing the previously postponed Canada and Mexico tariffs (which were, ultimately, mostly postponed again). These days saw the S&P fall by 3%, highlighting the market's overall dissatisfaction with the ongoing trade turmoil.

- The AV Employment Index (AVI-E) stayed unchanged at 55.3 in February. Last month, the AVI-E of 55.3 was a bright spot in clear contrast to the low AVI-S. There is still some of that sentiment since typically the AVI-E is closer to 50 than the AVI-S (employment changes more slowly than sales), but overall, the two indexes are now roughly aligned. They are both telling a story of slow but still meaningful growth. In the wider economy, the U.S. labor market saw the addition of 151,000 jobs, a decent level that did not stop the unemployment rate from ticking up a tenth of a percent to 4.1%. Employment is a well-known lagging indicator, so any fallout from tariffs and uncertainty would not be expected to factor in fully for a few months at least.

International Outlook

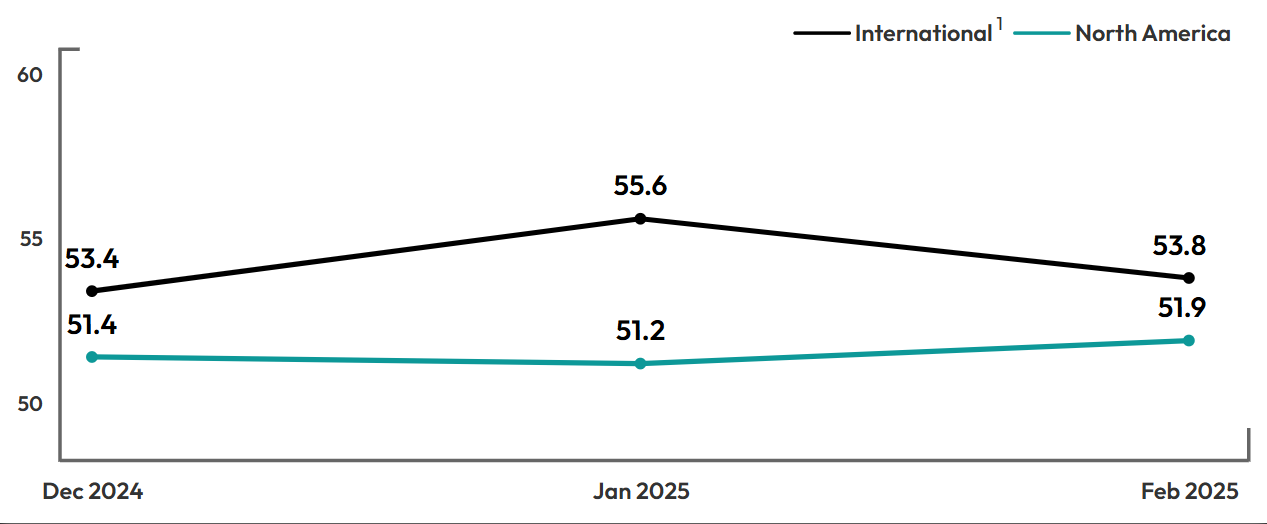

North American growth stayed at an anemic level while the rest of the world slid slightly — from a moderate to a slow level — in our initial reading for February 2025.1 North American growth has been the laggard for nearly two years, which shows no signs of abating—particularly with the tariff uncertainty centered in the U.S. and extending from there into Mexico and Canada. Going forward, we expect continued slow growth in North America while we anticipate some modest acceleration in the rest of the world..

1Due to the small sample, the North American and International indexes are based on a 3-month moving average. The January 2025 index is preliminary, based on the average of January and February 2025 and will be final with March 2025 data in the next report.

1AVIXA®, the Audiovisual and Integrated Experience Association, has published the monthly Pro AV Business Index since September 2016, gauging sales and employment indicators for the pro AV industry. The index is calculated from a monthly survey that tracks trends. Two diffusion indexes are created using the survey: the AV Sales Index (AVI-S) and AV Employment Index (AVI-E). The diffusion indexes are calculated based on the positive response frequency from those who indicated their business had a 5% or more increase in billings/sales from the prior month plus half of the neutral response. An index of 50 indicates firms saw no increase or decline in business activity; more than 50 indicates an increase, while less than 50 indicates a decrease.

US federal government changes are heavily impacting planning, resources, funding and overall climate in the Washington DC area. We are concerned about integrators remaining in business due to cancelled projects and reduction in new projects from both government and government contractor clients

End User, North America

The threat of tariffs has us assessing the potential financial impact and determining how to pass these on while not upsetting customers

AV Integrator, North America

Supply chain issues have improved. Some manufacturers have not met their introduction dates of updated DSP programming applications or technology updates, but alternatives are available for implementation. Manufacturers have advised regarding Q2 material and equipment price increases pending Federal Tariff adjustments to trade.

Av Integrator, APAC

Methodology

The survey behind the AVIXA Pro AV Business Index was fielded to 2,000 members of the AVIXA Insights Community between February 28 2025, and March 5, 2025. A total of 285 AV professionals completed the survey. Only respondents who are service providers and said they were “moderately” to “extremely” familiar with their company’s business conditions were factored in index calculations. The AV Sales and AV Employment Indexes are computed as diffusion indexes. The monthly score is calculated as the percentage of firms reporting a significant increase plus half the percentage of firms reporting no change. Comparisons are always made to the previous month. Diffusion indexes, typically centered at a score of 50, are used frequently to measure change in economic activity. If an equal share of firms reports an increase as reports a decrease, the score for that month will be 50. A score higher than 50 indicates that firms, in the aggregate, are reporting an increase in activity that month compared to the previous month. In contrast, a score lower than 50 is a decrease in activity.

About the AVIXA Insights Community

The AVIXA AV Intelligence Panel (AVIP) is now part of AVIXA’s Insights Community, a research group of industry volunteers willing to share their insights on a regular basis to create actionable information. Members of the community are asked to participate in a short, two-to-three-minute monthly survey designed to gauge business sentiment and trends in the AV industry. Community members will also have the opportunity to participate in discussions, polls and surveys.

Community members will be eligible to:

- Earn points toward online gift cards

- Receive free copies of selected market research

- Engage directly with AVIXA's market intelligence team to help guide research

- Ask and answer other industry professionals' questions

The Insights Community is designed to be a global group, representative of the entire commercial AV value chain. AVIXA invites AV integrators, consultants, manufacturers, distributors, resellers, live events professionals, and AV technology managers to get involved. If you would like to join the community, enjoy benefits, and share your insights with the AV industry, please apply here