Pro-AV Business Index

April Still Holding Strong

Highlights

- The tariff uncertainty continues to remain a top concern within the pro AV industry. Over the past three months, the AV Sales Index (AVI-S) has consistently shown expansion. March saw the highest growth, with a slight moderation in April. Despite the small dip from March(60.9) to April (59.7), the overall trend remains positive, indicating sustained growth in the sector.

The AV Employment Index (AVI-E) bounced back in April to 55.5 from 53.5. The AVI-S and AVI-E continue to show modest growth of the industry. The U.S. economy added 177,000 jobs in April exceeding the expected 138,000. The government revised previous months downward. March’s figure was adjusted down to 185,000 and February’s was revised down even more sharply to just 85,000 new positions, this suggests the labor market hasn’t been quite as robust as initially reported. Unemployment remains at 4.2%. The impact of federal layoffs and tariffs are expected to have broader effects in the coming months.

International Outlook

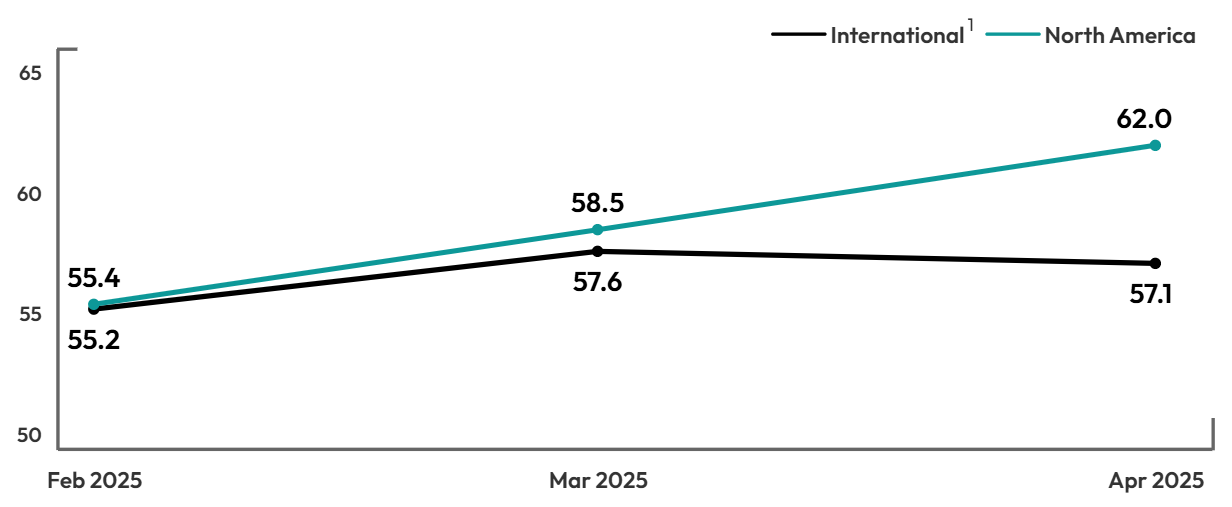

With the newly finalized numbers in our moving average for April, North America exceeded the rest of the world, 58.5 to 57.6. This is North America’s highest index since May 2024. Now in April, North America continued to outpace the rest of the world 621 at its initial reading versus 57.11 for the rest of the world. Shared growth is ideal for the industry.

1Due to the small sample, the North American and International indexes are based on a 3-month moving average. The April 2025 index is preliminary, based on the average of March and April 2025 and will be final with May 2025 data in the next report.

1AVIXA®, the Audiovisual and Integrated Experience Association, has published the monthly Pro AV Business Index since September 2016, gauging sales and employment indicators for the pro AV industry. The index is calculated from a monthly survey that tracks trends. Two diffusion indexes are created using the survey: the AV Sales Index (AVI-S) and AV Employment Index (AVI-E). The diffusion indexes are calculated based on the positive response frequency from those who indicated their business had a 5% or more increase in billings/sales from the prior month plus half of the neutral response. An index of 50 indicates firms saw no increase or decline in business activity; more than 50 indicates an increase, while less than 50 indicates a decrease.

We started the year with high activity due to projects that couldn't be invoiced last year. However, due to the tariffs business will be affected. There are companies leaving our country and the new investments have stopped.

AV Integrator, North America

WE are not doing layoffs. Rather we are choosing to delay replacement hires until the economy picture is clearer.”

AV Integrator, North America

Clients are withholding commitments due to economic transition and uncertainty. Tariff concerns with price and supply is high.

Av Integrator, APAC

Methodology

The survey behind the AVIXA Pro AV Business Index was fielded to 2,000 members of the AVIXA Insights Community between April 28, 2025 and May 5, 2025. A total of 295 AV professionals completed the survey. Only respondents who are service providers and said they were “moderately” to “extremely” familiar with their company’s business conditions were factored in index calculations. The AV Sales and AV Employment Indexes are computed as diffusion indexes. The monthly score is calculated as the percentage of firms reporting a significant increase plus half the percentage of firms reporting no change. Comparisons are always made to the previous month. Diffusion indexes, typically centered at a score of 50, are used frequently to measure change in economic activity. If an equal share of firms reports an increase as reports a decrease, the score for that month will be 50. A score higher than 50 indicates that firms, in the aggregate, are reporting an increase in activity that month compared to the previous month. In contrast, a score lower than 50 is a decrease in activity.

About the AVIXA Insights Community

The AVIXA AV Intelligence Panel (AVIP) is now part of AVIXA’s Insights Community, a research group of industry volunteers willing to share their insights on a regular basis to create actionable information. Members of the community are asked to participate in a short, two-to-three-minute monthly survey designed to gauge business sentiment and trends in the AV industry. Community members will also have the opportunity to participate in discussions, polls and surveys.

Community members will be eligible to:

- Earn points toward online gift cards

- Receive free copies of selected market research

- Engage directly with AVIXA's market intelligence team to help guide research

- Ask and answer other industry professionals' questions

The Insights Community is designed to be a global group, representative of the entire commercial AV value chain. AVIXA invites AV integrators, consultants, manufacturers, distributors, resellers, live events professionals, and AV technology managers to get involved. If you would like to join the community, enjoy benefits, and share your insights with the AV industry, please apply here