The Real Cost of Your People: Understanding Labor Burden

Do you own or run a business? What is the value of your employees? Not their value as irreplaceable assets, brand ambassadors, or knowledge torchbearers — their monetary value.

If you’re smart, especially in today’s climate, you’re keeping very close track of how much your business is spending. On everything. You’re most likely looking at your expenses more thoroughly than you have in a very long time. This is good, because there’s a high likelihood that you’ve been losing money you didn’t even know you were losing, on a very significant expense that you may have even thought you had under control: your people. Are you sure you’re figuring the real value, and cost, of your labor force? Would you be surprised if you knew that the hourly rate you pay someone is less than half of your labor burden in most circumstances?

Related: Project Management for AV

While we all know that running a business has never been more challenging, accurately accounting for your labor costs is an area that can have a huge effect on your profit margin but is often ignored or miscalculated. How do you account for your labor?

“Service companies are more likely to spend time figuring out the direct and indirect costs of personnel because of the nature of their business.”

Product vs. Service Costs

It’s easy to figure out how much a product is costing you, but the way you account for the cost of creating that product and selling it has a huge effect on the long-term health of your business. If you underassess your labor burden, you could end up with a very inaccurate picture of where your money is going, how much you should be bidding or charging, and how well you are protecting and valuing your greatest assets: your employees.

Service companies are more likely to spend time figuring out the direct and indirect costs of personnel because of the nature of their business.

Manufacturers often focus more on the product itself, and see their employees as a necessary, but untracked, expense. They may put their time into an “overhead expenditure” category, but that doesn’t tell the whole story of what the company’s return actually is on their investment in people.

Related: Enduring Through Difficult Times

Adding Up the Numbers

Calculating the cost of your labor involves creating a framework that considers all of the ways that having that employee “burdens” your company financially. Having a firm grasp on that number gives you the data you need to be able to manage your expenses and bid for true profit. You’ll be able to plan for future growth, develop your team, and stay financially healthy.

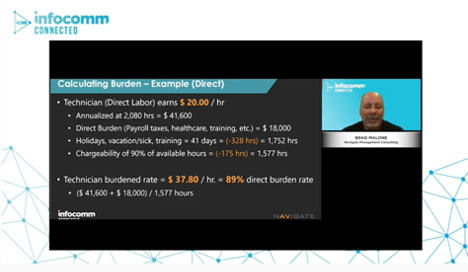

During InfoComm 2020 Connected, Brad Malone, PMP, offered a concise explanation of how to calculate your true labor burden and provides practical information that you can and should use in your resource planning during both good times and bad.

Understanding Labor Burdens - Calculating Burden Example

Understanding Labor Burdens - Calculating Burden Example

Measure to Manage

Based on your business model, you’ll have some decisions to make about the method you use for calculating these labor costs, and you’ll review some terms, such as direct versus indirect labor, chargeability versus utilization, direct versus full labor burden, fixed versus variable costs. Brad provides examples and worksheets. Did you know that underburdening your people inflates your gross margin? Translation: The cost of your staff is eating into your profits because you are not considering all the costs involved in having them on your team.

Watch the full session: Understanding Labor Burdens to Recover Your Costs